Smarter Tenant

Decisions with AI-

Powered Renter Scoring

Have more questions? Contact Sales

Preview the report

A single, simple report packed with real data. Watch as bank statements become insights, helping you see who’s financially fit to rent your property.

Nils Decker

Renter Score Insights for Nils

What we predict

Our AI-powered scoring goes beyond credit checks to give you a clearer picture of your potential renter. We analyze real financial data to determine affordability, stability, and reliability.

Affordability

Does your potential renter have enough income to comfortably cover the rent each month? Our unique analysis looks at real deposits and expenses to gauge true affordability.

Stability

Life can throw curveballs. Our predictive model checks for the renter’s ability to handle sudden expenses or short-term income dips. You’ll know if they can weather a storm without missing rent.

Reliability

Past behavior is a strong indicator of future performance. We measure financial discipline—like consistent on-time payments—to predict the likelihood they’ll pay rent promptly.

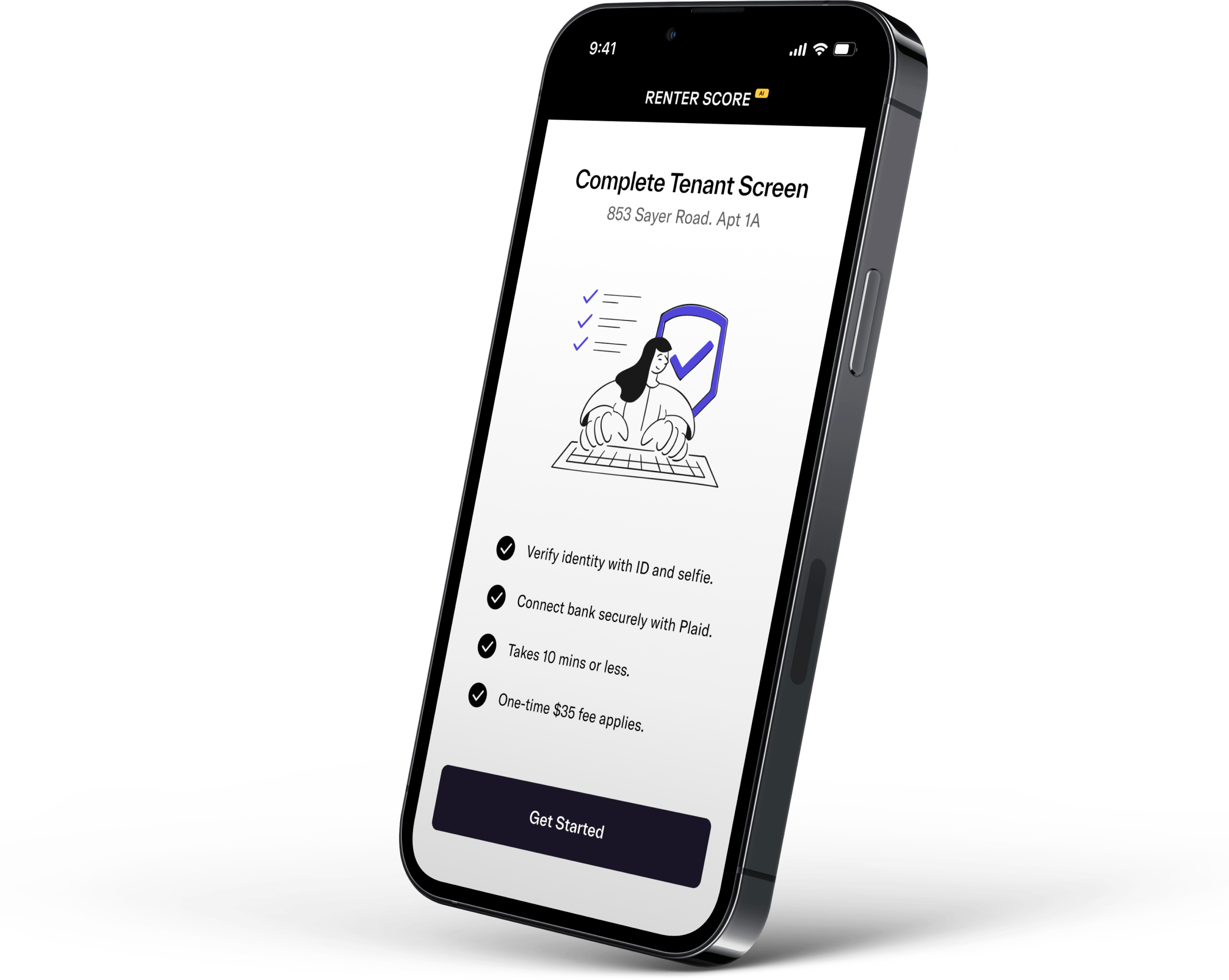

What’s Included

Full Financial Health Analysis

Predictive Tenant Scoring

Actionable Insights

Free for the Landlord

paid by the Applicant

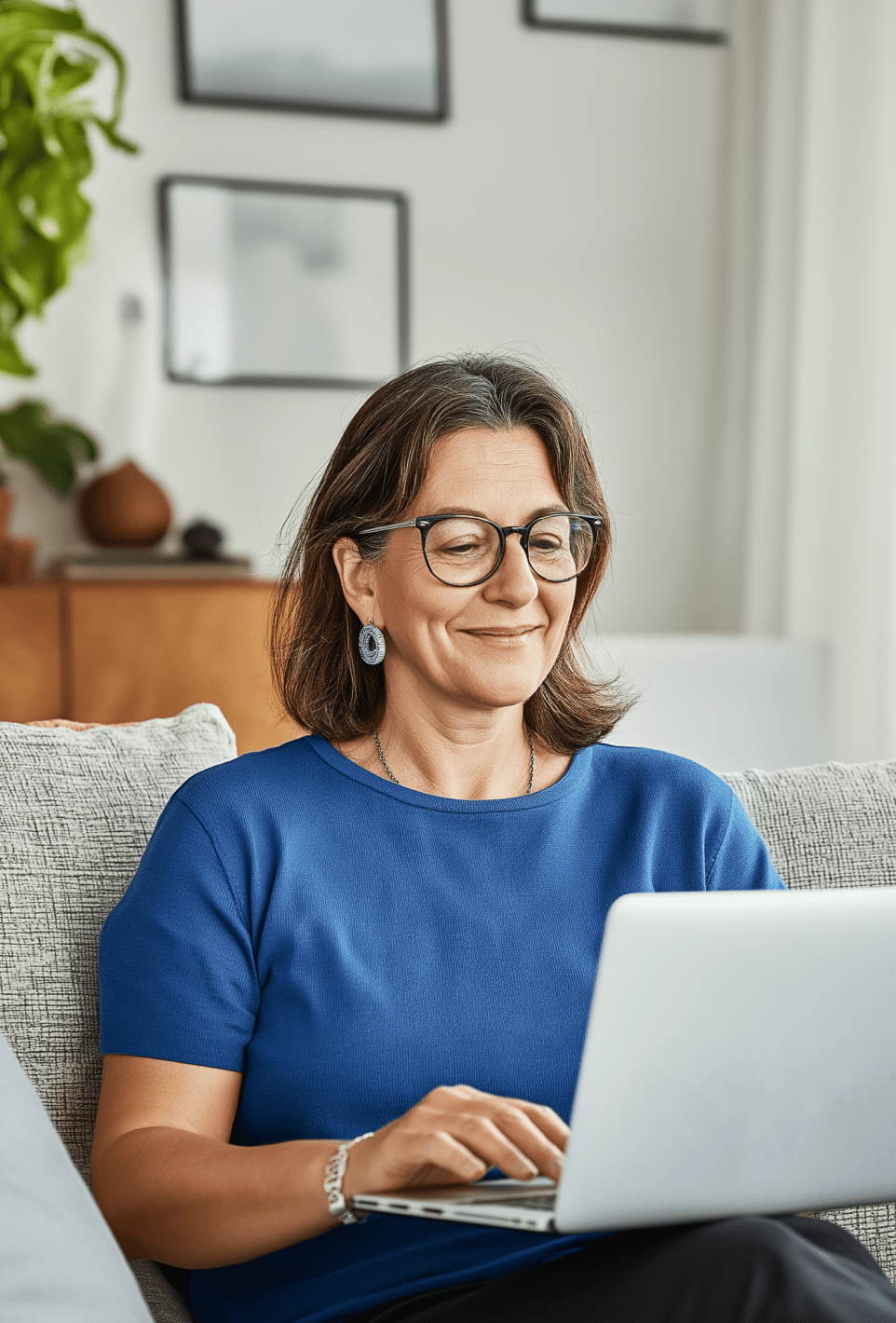

Why Renter Score?

5Minutes

Send your renter a quick link, and their score is ready almost instantly—faster decisions, better outcomes.

3xMore data

We go beyond a simple credit check, reviewing real deposits and expenses for a full financial picture.

50k+Renters screened

Our model flags potential risks and reveals if renters can handle

surprises—so you can lease with confidence.